Tesla's Impact on Agriculture

/Tesla has now sold more than 3 million cars worldwide. There is no doubt that automotive manufacturers are shifting research and development dollars towards making more electric vehicles (EVs) in order capture some of Tesla’s growing market dominance in this space. If you, like me, love cars, trucks and other motorized vehicles, it’s interesting to wonder what changes Tesla’s disruption will have on agriculture. At a recent speaking engagement to a group of foreign ag leaders, I was asked to speculate about how Tesla might impact US agriculture. Here is my list.

More all-electric powertrains. Very early on in the company’s product planning days, Tesla abandoned the idea of hybrid drive—using electric power and internal combustion together. Hybridization created needless complexity in Elon Musk’s eyes. All electric was simpler and easier to control with computers, something that would be necessary in the autonomous driving future.

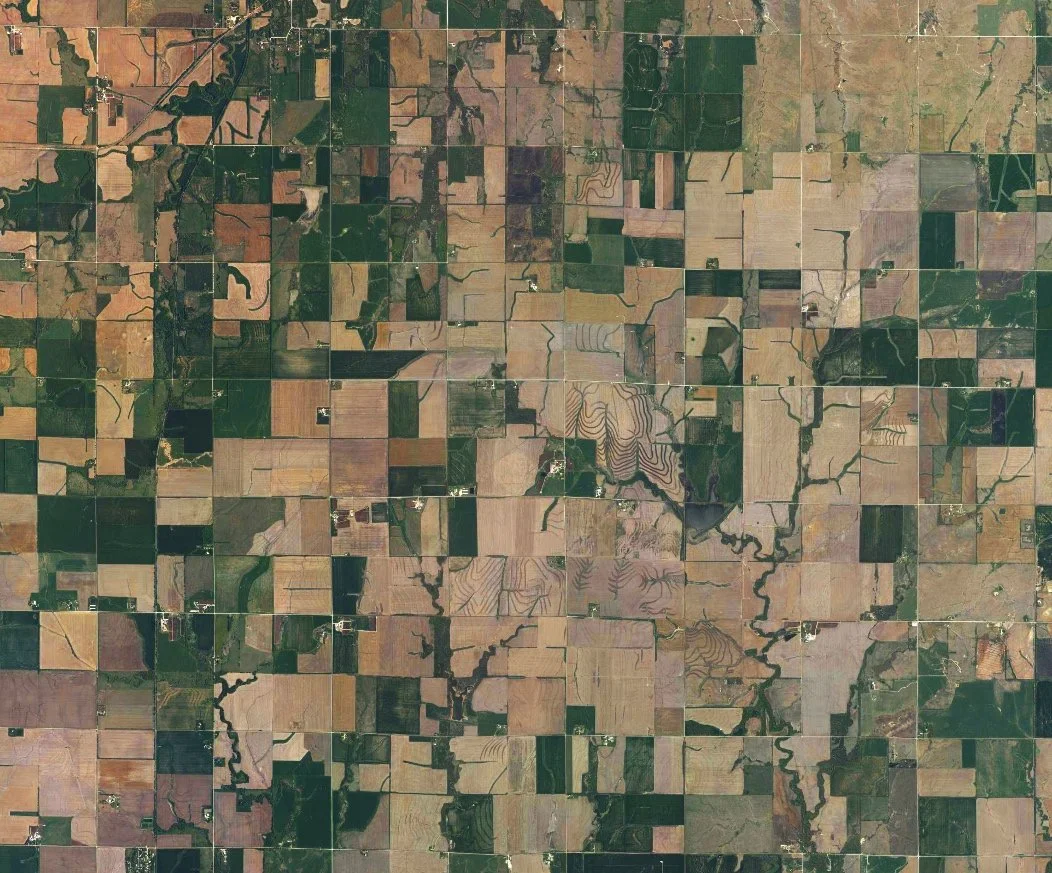

All electric is also better to combat climate change, reducing the fossil fuel consumption during the life of vehicle to nearly zero (assuming that vehicles are powered by renewal energy sources). For this reason, I think we will see more electric vehicles on the farm, too. Farmers are under increasing pressure to reduce their carbon footprints and EVs can help. Although we have seen a few EV concepts on the farm, the mainstream entries have not yet appeared.

Disruption of the dealer network. Tesla has never embraced a dealership model. There are no Tesla dealerships in the US, only Tesla-owned stores and service centers. This has no doubt slowed Tesla’s ability to grow in certain markets, but the lack of a dealer infrastructure has also allowed Tesla complete control over supply and distribution of its cars. In today’s supply-chain-disrupted economy, we are seeing reports of automotive dealers gauging customer by charging prices over MSRP. Tesla avoids this middle-man taking his cut but cutting him out.

We will not likely see farm equipment manufacturers eliminate their entrenched dealer networks, but that does not mean there will be no Tesla-effect on farm equipment dealers. Like Tesla, farm equipment companies are increasingly developing a direct relationship model with their customers by creating cloud-based programs for these customers. The dealer may still sell and service the hardware—the tractor, combine, or planter—but the software is managed, updated, and supported by the manufacturer. The farm equipment dealer may not face extinction, but their role will shift to more tech support than engine repair.

More data for our autonomous future. Tesla vehicles are connected to the Tesla mothership cloud almost all the time. Data from its cars are constantly being fed back to Tesla, which updates cars’ software to add new features and fix bugs. Equally important, Tesla uses this constant data feed to improve its “autopilot” and self-driving software. Autonomous driving is part of experience Tesla is selling. Other automakers have adopted this same model, selling Supercruise (GM), Bluecruise (Ford), and autonomous features.

We see the same trend in farm equipment. Constant connectivity allows the machine to stay connected to the manufacturer’s cloud at all times. This helps the manufacture improve the software and anticipate mechanical problems. Equally as important but not as realized, the constant cloud connectivity allows for real time machine learning. A sprayer gets smarter about spraying the targeted weeds as it learns from all sprayers in all fields. This is a big change from farming 10 years ago.

Tesla, more than any other automotive manufacturer, has caused automotive manufacturers to rethink human transportation. The same trends are on their way in agriculture.